India’s largest bank, the State Bank of India (SBI), has once again proven why it remains a cornerstone of the country’s financial system. With its recent Q3 FY25 results turning heads, investors are asking: Is SBI’s stock a hidden gem in plain sight? Let’s do the SBI stock analysis and unpack its performance, growth drivers, and whether it’s time to bet on this banking behemoth.

SBI’s Q3 FY25: A Powerhouse Performance

SBI reported an 84% YoY surge in net profit for Q3 FY25, driven by robust loan growth, controlled operating expenses, and record-low credit costs. Here’s what stood out:

Loan Growth: Advances grew by 13% YoY, with SME loans (fastest-growing segment) and corporate loans (+15% YoY) leading the charge. Retail loans slowed to 12%, but gold loans soared by 42%.

Asset Quality: Gross and net NPAs hit a 10-year low, with credit costs at historic lows. The bank expects credit costs to stabilize at ~50 basis points, signaling confidence in asset quality.

Margins & Profitability: Net Interest Margin (NIM) dipped slightly but stayed above 3%. Management expects margins to hold steady even if rates drop, supported by potential treasury gains.

Efficiency Boost: Operating expenses fell, pushing the cost-to-income ratio down to 48.5%—a win for profitability.

With a colossal balance sheet of over ₹66 lakh crore, SBI delivered an impressive Return on Assets (ROA) of 1%+, a rare feat for a bank of its size.

Growth Engines: Where’s SBI Headed?

1. SME & Corporate Lending in the Fast Lane

The Union Budget’s push to double MSME classification limits and enhance credit guarantees has supercharged SME lending. SBI’s SME book is now its fastest-growing segment, while corporate loans (34% of domestic loans) saw 15% growth. A strong project pipeline suggests corporate demand will fuel future credit expansion.

2. Deposit Growth: A Temporary Hiccup?

Deposits grew 10% YoY, lagging behind advances. However, SBI’s credit-deposit (CD) ratio of 68.9% remains comfortably below the industry average. Management sees room to push this to 75%, implying ample liquidity to support 14-16% loan growth—a rate outpacing the broader banking sector.

3. Retail Slowdown: A Silver Lining

Retail loan growth slowed to 12%, with unsecured “Xpress Credit” plunging from 16% to 3% YoY. While this reflects regulatory caution, the surge in gold loans (+42%) shows SBI’s agility in adapting to market trends.

Valuation: Why SBI Looks Like a Steal

At ₹752 per share, SBI trades at just 1x its FY26 core book value—a bargain for a bank generating a 20% Return on Equity (ROE). Analysts argue the stock is priced as if its valuable subsidiaries (like SBI Life, Mutual Funds, etc.) come free. Historically, SBI traded at 1.3-1.5x book value, suggesting a 30-50% upside if it re-rates.

The Peter Lynch Fair Value model pegs SBI’s intrinsic value at ₹2,004.46, implying a 172% upside from the current price (~₹737). While models aren’t foolproof, the gap between price and value is hard to ignore.

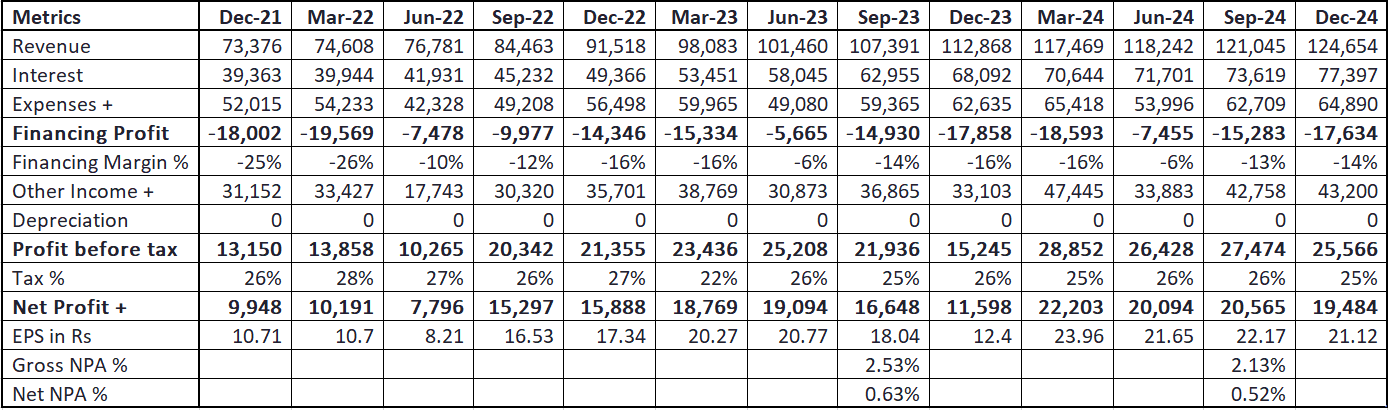

Quarterly Results

Risks to Watch

Rate Cuts: A sharp reversal in interest rates could pressure margins.

Economic Slowdown: Weak GDP growth may dent credit demand.

Competition: Private banks and NBFCs vying for market share.

FAQs: Your Burning Questions Answered

1. Is SBI Undervalued or Overvalued?

Undervalued. Trading at 1x FY26 book value vs. historical 1.3-1.5x. Its ROA/ROE and subsidiaries’ hidden value aren’t fully priced in.

2. Is SBI a Bullish or Bearish Bet?

Bullish for long-term investors. Strong asset quality, government backing, and sector-leading size make it a resilient pick.

3. What’s the Target Price for SBI?

Analysts expect a re-rating to 1.3-1.5x book value, implying a 12-18-month target of ₹980-1,128. The Peter Lynch model suggests even higher upside (~₹2,004).

4. Why Invest in SBI Now?

Attractive valuations.

Improved asset quality and stable margins.

Government policies favoring SME growth.

Potential stake sales (e.g., Yes Bank) could unlock value.

5. What About Dividends?

With rising profits, SBI is likely to sustain/bump up dividends. Its payout ratio has room to grow.

6. How Safe is My Investment?

SBI’s “too big to fail” status, low NPAs, and diversified loan book reduce risk. However, macroeconomic shocks remain a wildcard.

SBI isn’t just a bank—it’s a proxy for India’s economic growth. While its stock has lagged private peers, Q3 FY25 proves the bank is hitting its stride. For investors with a 3-5-year horizon, SBI offers a rare mix of safety, growth, and deep value. As the old market saying goes: “When the giant wakes up, even the bears run.”

Disclaimer: This is not investment advice. Conduct your own research or consult a financial advisor. You can also look into our research on DMART